Contributed by: Nicholas Boguth

Bonds are a hot topic in the investment community today while we patiently await a rise in interest rates from the Fed. We know that interest rates affect the bond market, but how? In order to truly gain a better understanding of how the bond market works, we’re going back to the basics to address some important fundamental questions that all investors should understand.

First off, what is a bond?

A bond is a debt instrument that a company or government uses to borrow money. A corporation may need cash in order to build new factories; a government may need cash to build a bridge, etc. In order to borrow money, they sell you (the investor) a bond that basically says, “We owe you.” By selling these bonds, they are able raise a large amount of cash, and pay it back over time.

It is important to note that the major difference between bonds and stocks is that bonds are debt, and stocks are equity. If you own a bond, you own a portion of the issuer’s debt. If you own a stock, you own a portion of the company. The upside of owning a bond is that you receive back principal plus interest; you have higher priority for getting paid if the issuer goes bankrupt, and you don’t lose money because the stock price declines. The downside is that you don’t share the issuer’s future profits or participate in rising stock prices. These factors are why bonds are typically considered “less volatile” investments.

What is a coupon?

Bonds pay interest to you, the investor. A coupon is simply the amount of money that you receive at each interest payment (typically every six months). Par value, or the issuer’s price of a bond, is typically $1000. If a bond has a 5% coupon, then you receive 5% of $1000 every year; or $25 every 6 months.

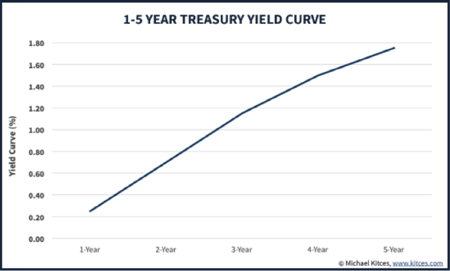

What is yield?

A bond’s yield is a measure of its return. Current yield is calculated by taking the coupon payment and dividing by the current price of the bond. When a bond is trading at par, rather than at a discount or premium, the yield is equal to the coupon payment: $50 coupon payment/$1000 bond price = 5% yield. If the price of that same bond rose to $2000, then the current yield would be $50/$2000 = 2.5%. The yield is lower because you had to pay more money for the bond. The opposite would be true if you bought the bond at a discount. The Yield to maturity is another measure of return. It reflects the return you would get if you held the bond all the way to maturity. For you investors, it is important to understand what coupons and yields are in order to understand their relationship to pricing and interest rate changes.

Why do bond prices go down when interest rates go up?

When interest rates rise, new bonds that are being issued will have higher coupon payments than the old bonds that were issued in the lower interest rate environment. Why would anyone ever buy one of those old bonds that have smaller coupons? If they were the same price, they wouldn’t! This is why bond prices fall when interest rates rise. In order for the yield to be equal between the bond with the higher coupon and the bond with the smaller coupon, the bond with the smaller coupon would have to be cheaper.

This material is being provided for information purposes only and is not a complete description, nor is it a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Nick Boguth and not necessarily those of Raymond James. Investments mentioned may not be suitable for all investors. Investing involves risk and investors may incur a profit or a loss. The hypothetical examples are for illustration purpose only and do not represent an actual investment.

There are special risks associated with investing with bonds such as interest rate risk, market risk, call risk, prepayment risk, credit risk, reinvestment risk, and unique tax consequences. To learn more about these risks and the suitability of these bonds for you, please contact our office.