Contributed by: Angela Palacios, CFP®

2016 kicks off with much of the same challenges as have plagued us for the second half of 2015. The S&P 500 was up for the seventh straight year but that is where the excitement ended. Broad markets delivered lackluster or negative returns. The S&P 500 needed all of its dividends to get to a positive 1.38% return for 2015 while the Russell 2000 and MSCI EAFE representing small company stocks and international markets were down 4.42% and .82% respectively.

Volatility really picked up in the third quarter with a large drawdown while in the fourth quarter made up some ground. We expect volatility to continue into the New Year as the year end brought no significant changes to our outlook.

Liftoff from Zero

The Federal Reserve Board (FED) continues to ease their foot slowly off the accelerator after years of easy money. In December, The FED increased short term rates for the first time in nearly a decade. This move was highly anticipated and thus bonds did not have a large knee-jerk negative reaction. Bond markets had already priced in the rate move before it happened.

Looking forward, The FED is forecasting 4, quarter point rate increases for a total of a 1% rate increase in 2016. The markets, as measured by interest rate futures, disagree as they are forecasting only .5% increase this year. If The FED actually increases rates by 1% the bond market will adjust prices to reflect this leading to slight negative pressures on the prices of bonds. Interest rates on bank accounts will lag behind the increases and likely only move upward slightly and slowly while mortgage rates should also increase slowly.

A bright spot in the bond market

The outlook for municipal bonds continues to be positive. Puerto Rico announced a default on January 1 of $37 Million in debt but this was widely anticipated and didn’t spread into other markets. Many municipalities continue to improve balance sheets with increased tax collection and the market as a whole seems to be on solid footing.

Bond Market Illiquidity

The negative performance in energy prices has led to increasing spreads between high yield bonds and investment grade fixed income. When this occurs, prices on high yield bonds go down and they become harder to sell. Over the past several years, investors have reached for yield in this category not understanding the risks involved. This highlights the importance of understanding exactly what exposure you are taking on when investing in fixed income.

View on Emerging markets

Emerging market challenges continue into 2016. Manufacturing in China continues to slow as well as their Gross Domestic Product growth, GDP, but the government is intervening in their stock market trying to prove they can provide a floor to asset prices. China’s slowdown has had a negative impact on commodity prices along with the glut in the oil market causing oil prices to be at their lowest levels since early 2009.

These pressures have been brutal to emerging market country currencies that depend on exporting commodities. In order for there to be a turnaround in this space we would need to see a change in investor sentiment, stronger economic growth, and a weakening of the U.S. dollar which we don’t see as likely in the near term.

The Economy

Locally our economy continues its slow grind in the positive direction. Consumer spending remains strong with low gas prices and strong job growth increasing households’ purchasing power. Housing is a bright spot and as rates increase borrowing terms may be relaxed a bit by lenders which would be helpful. Inflation may start to pick up slightly from very low levels now. As energy prices find a bottom this would cease being a negative effect on inflation and may even start to add to year-over-year inflation as we start to rise off the bottom.

Here is some additional information we want to share with you this quarter:

Checkout my research summary in the quarterly Investment Pulse.

I delve into Out of the Box Investing with a look at alternative investments.

Melissa Joy, CFP®, Partner, chimes in with a timely reminder of 5 Questions to ask yourself when stocks are down.

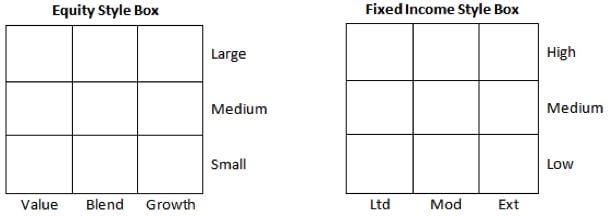

Nick Boguth, Client Service Associate, giving his insight on Style Box Investing basics.

Check out an article on Diversification from Jaclyn Jackson, Research Associate, to help better understand the benefits.

Vice President and Global Market Strategist for J.P. Morgan, David Lebovitz, and The Center's Melissa Joy, CFP®, will discuss timely market and economic insights. REGISTER for the webinar!

Careful diversification and financial planning are tools to help support investor patience in choppy markets. Don’t forget Warren Buffett’s wise advice, “The stock market is a device for transferring money from the impatient to the patient.” Patience remains a cornerstone to our investment process here at The Center. We appreciate your continued trust. If you have any questions or would like to discuss further, do not hesitate to reach out to us!

On behalf of everyone here at The Center,

Angela Palacios CFP®

Director of Investments

Financial Advisor

Angela Palacios, CFP® is the Portfolio Manager at Center for Financial Planning, Inc. Angela specializes in Investment and Macro economic research. She is a frequent contributor to Money Centered as well as investment updates at The Center.

David Lebovitz and JP Morgan are not affliated with Raymond James. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. This material is being provided for information purposes only and is not a complete description, nor is it a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Angela Palacios and not necessarily those of Raymond James. Past performance may not be indicative of future results. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Investing in emerging markets can be riskier than investing in well-established foreign markets. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility. There are special risks associated with investing with bonds such as interest rate risk, market risk, call risk, prepayment risk, credit risk, reinvestment risk, and unique tax consequences. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The Russell 2000 Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represent approximately 8% of the total market capitalization of the Russell 3000 Index. The MSCI EAFE (Europe, Australasia, and Far East) is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the United States & Canada. The EAFE consists of the country indices of 22 developed nations. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary.