Contributed by: Nicholas Boguth, CFA®, CFP®

Contributed by: Nicholas Boguth, CFA®, CFP®

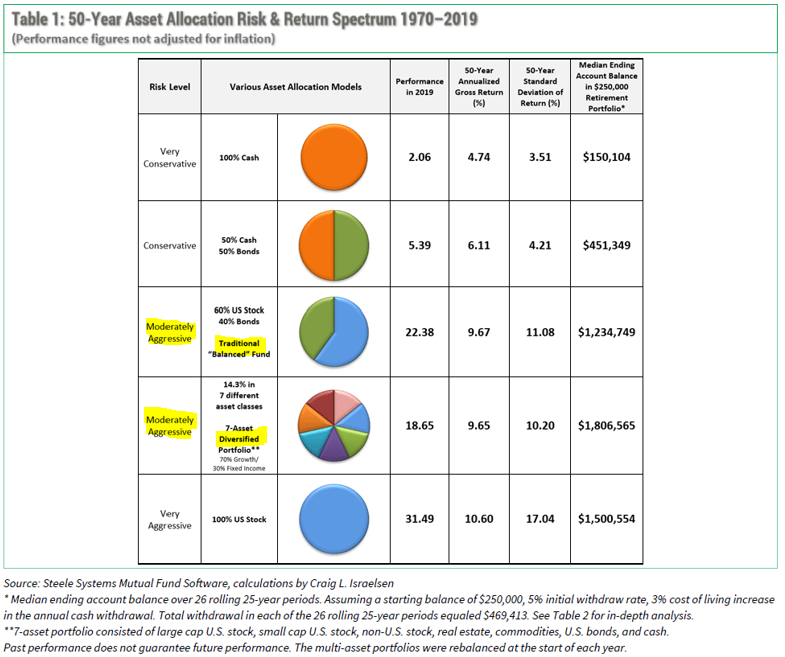

The Center’s investment committee meets every month, and one of the most regularly discussed topics is the “Strategic Allocation” of our portfolios. The Strategic Allocation is what proportion of our portfolios should, at the highest level, be invested in stocks versus bonds. Then, beyond that, what proportion of the equities should be in large capitalization stocks, small cap, internationally developed, emerging market, and alternative equity asset classes. The same thing on the bond side of the equation when thinking about the proportion of bonds that should be in “core” bond asset classes like treasuries, high-grade corporates, and asset-backed bonds compared to riskier bonds such as high yield, emerging market, long duration, or alternative bond asset classes.

Those discussions may not sound entertaining to you, but we get very energized and spend a lot of time on them because asset allocation is probably the most important decision anyone can make as an investor. This is also why we write about it extensively (sometimes spicing it up with fun analogies…).

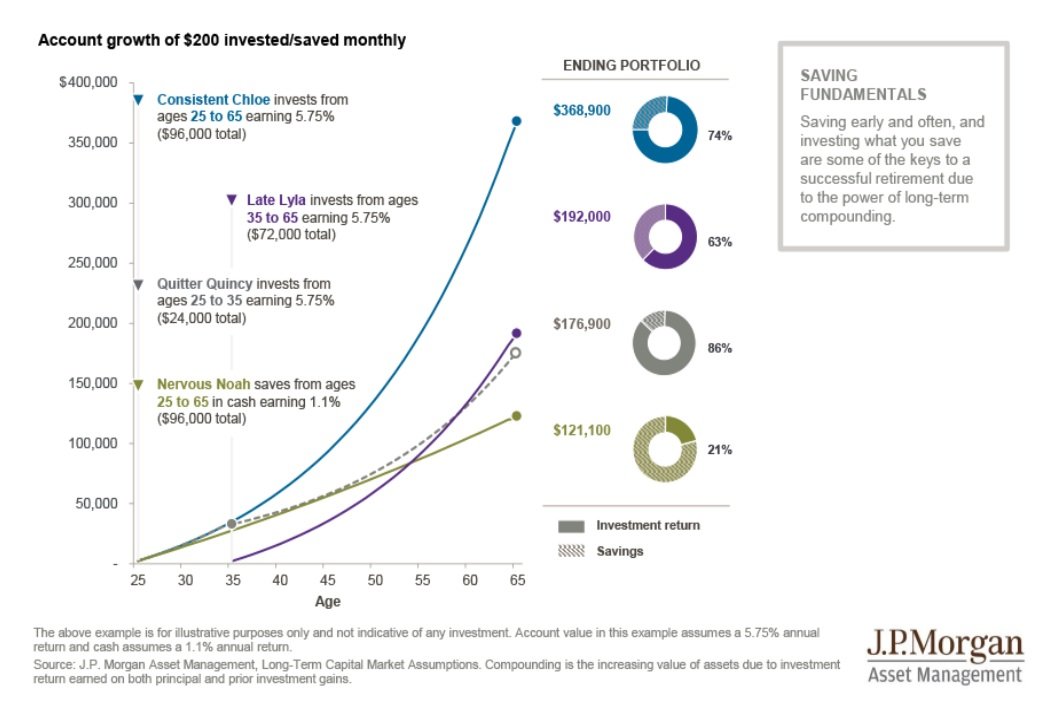

I recently listened to a podcast on nutrition and healthy eating habits and couldn’t help but notice the similarities between that topic and asset allocation. The guest on the podcast explained that there is no perfect one-size-fits-all diet for everyone. The ideal diet is the one that gets you to maintain your healthy target weight goal and the one that you will stick with for your ENTIRE life. A quick-fix diet can help with short-term goals, but if you go back to your original diet, there is a good chance that progress will fade. The same goes for investing.

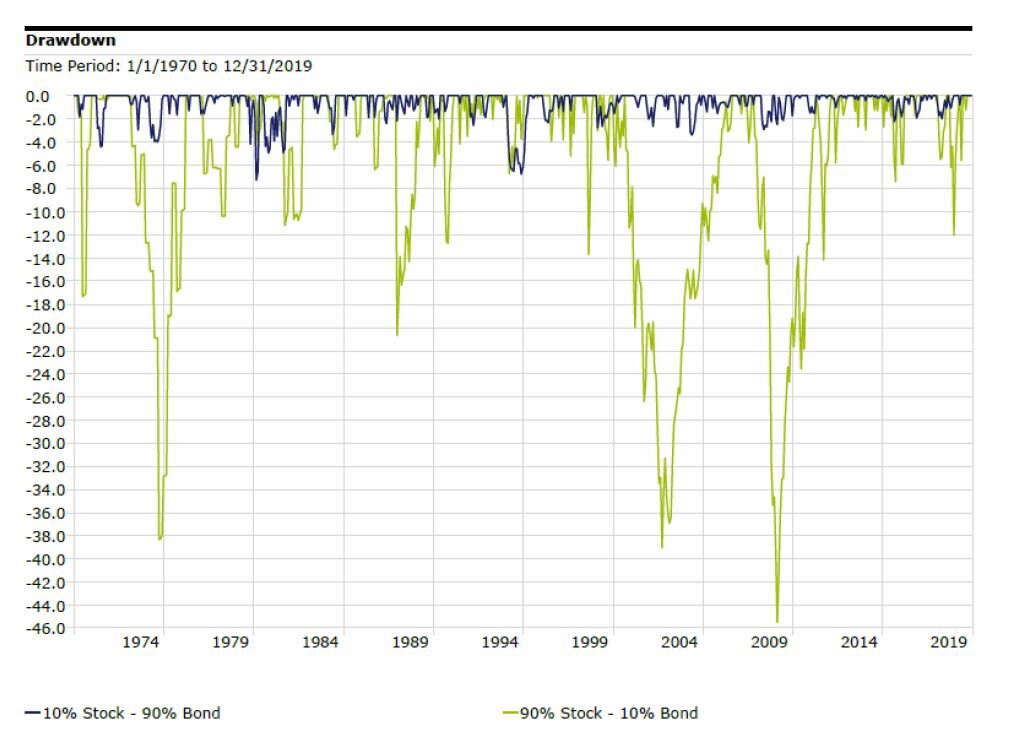

As financial advisors and portfolio managers, we are committed to helping you create the portfolio that successfully gets you to your target financial goal, AND to find the strategy that you will stick with for your entire investing life. Your asset allocation is useless if you are not committed to it, make changes every time there is a market headline or upcoming election, if it causes more stress than relief, or feel like you can’t take it anymore and would instead hold all cash. Quick fixes, reactive decisions, investing in the hottest asset class of the year, or moving to cash may (or may not) lead to short-term gains, but there is a good chance that progress will fade. Creating a strategy and asset allocation with the intention that you know you will stick with AND will get you to your desired goal is key.

Many factors will help determine what asset allocation is right for you, and we are here to help you figure out what those are – then implement them all the way through your successful financial plan. How much growth do you need from your portfolio? How much income do you need your portfolio to produce? How much volatility are you comfortable with in your portfolio? Do you have things that you want to invest in that we have to work together to fit into your asset allocation? These are just a few questions we want to work with you to answer. Please don’t hesitate to reach out if you’d like us to help you find your ideal asset allocation or implement it.

Nicholas Boguth, CFA®, CFP® is a Senior Portfolio Manager and Associate Financial Planner at Center for Financial Planning, Inc.® He performs investment research and assists with the management of client portfolios.

Securities offered through Raymond James Financial Services, Inc., member FINRA/SIPC. Investment advisory services are offered through Raymond James Financial Services Advisors, Inc.

Center for Financial Planning, Inc. is not a registered broker/dealer and is independent of Raymond James Financial Services.

This information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of the author and are not necessarily those of RJFS or Raymond James. Every investor’s situation is unique and you should consider your investment goals, risk tolerance and time horizon before making any investment or investment decision. Investing involves risk, investors may incur a profit or loss regardless of strategy or strategies employed. Asset allocation does not ensure a profit or guarantee against a loss.