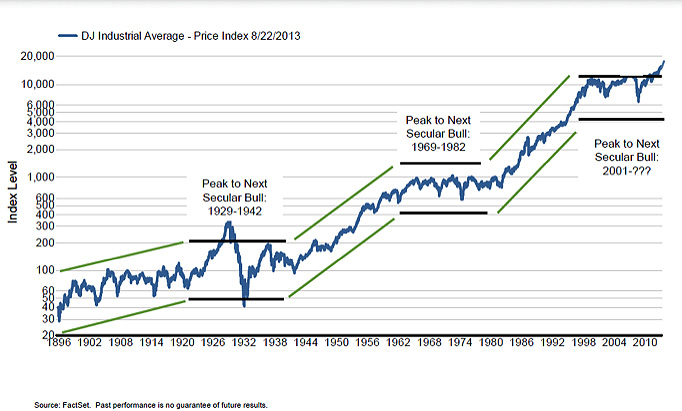

Many investors have been so successful they may face a potentially hefty tax bill for 2013. This bull market we are experiencing in the U.S. has had such strong legs for a long period of time many investors have few, if any, capital losses to harvest to help offset the gains they have accumulated in their equity investments. In some ways this is a great problem to have.

Tax Increases

This year there were a couple of noteworthy tax increases to keep in mind. The maximum tax rate on capital gains has increased from 15% to 20%. Taxpayers with taxable income north of $400,000 ($450,000 for couples) will be affected by this increase. There is also the new Medicare investment income “surtax” affecting taxpayers with modified adjusted gross income over $200,000 ($250,000 for couples). This tax is an additional 3.8% on investment income (interest, capital gains, dividends etc.).

Look for Bond Losses

Some taxpayers may still have tax losses from 2008-2009 to help offset gains, but for many these have run out during the successful run the markets have enjoyed for the past 4 ½ years. One place to look for some losses this year may be in the bond portion of your portfolio (if applicable). There may be an opportunity to swap to a similar investment for a short period of time, at least 31 days, to harvest those losses to help offset other gains you may have.

Harvesting Losses

Make sure you are reviewing your portfolio throughout the year for tax losses to harvest. Bond losses were at their peak during late summer and into the fall, but if you wait until December to harvest those losses, they could be much diminished from what they were. The end of the year is rarely the best time of the year to harvest tax losses. Personal circumstances vary widely so it is critical to work with your tax professional and financial advisor today to prepare for the risk of higher taxes in your future.

Angela Palacios, CFP®is the Portfolio Manager at Center for Financial Planning, Inc. Angela specializes in Investment and Macro economic research. She is a frequent contributor to Money Centered as well asinvestment updates at The Center.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James. You should discuss any tax or legal matters with the appropriate professional.