Checkout our current blog posts HERE. See you there!

Happy Memorial Day

We're Sorry, This Page is No Longer Available

Checkout our current blog posts HERE. See you there!

Kacy Supporters Helped Take a Step Toward a Cure

On Sunday May 5th the sun was out and we had the largest crowd yet as more than 400 runners, walkers, bikers and dogs turned out to support Kacy Wyman and the Cystinosis Research Network. Contributions are still coming in and we are grateful and proud to share that our community of supporters has raised near $30,000 for the Cystinosis Research Network. These funds will help with continued research projects to improve the quality of life for those dealing with Cystinosis and other rare diseases, and ultimately a cure!

On Sunday May 5th the sun was out and we had the largest crowd yet as more than 400 runners, walkers, bikers and dogs turned out to support Kacy Wyman and the Cystinosis Research Network. Contributions are still coming in and we are grateful and proud to share that our community of supporters has raised near $30,000 for the Cystinosis Research Network. These funds will help with continued research projects to improve the quality of life for those dealing with Cystinosis and other rare diseases, and ultimately a cure!

The last 12 months have been exciting for the Cystinosis community and Kacy. Recently the eye drops that Kacy takes each hour have been FDA approved, meaning the drops are now covered by insurance. This makes them more affordable and accessible for many families. Also, a slow release (12 hour) drug called Procysbi is expected to be available this year allowing kids (and their parents) with Cystinosis to hopefully get a full night sleep for the first time in many years. There is still much work to be done to find a cure and our fundraising is having an impact for Cystinosis and other rare diseases. Kacy's mom Jen Wyman continues to be active with the Cystinosis Research Network where the feeling is that these two advancements should have a positive impact on kids dealing with the disease.

The fun run/walk, like anything worthwhile, could not have been such a success without the help of so many people. Michelle & John Kelly, Kristin Prebay, and Jeff & Kathy Abrash have helped every year with food. Carrie Olds and Suzanne Neff have been stalwarts rounding up many route volunteers. Lori & Hadley Horton, Mike Neff, and Nona Cleary pitched in where needed every year as well. This year we are thankful to Kristin Cullen for arranging the donation of T-shirts. The list goes on….our generous sponsors… colleagues at The Center…Kacy’s swim club Atlantis……..all of these “little things” are not little….they add up to make a great event and we thank you all!

The CRN Fun Run/Walk has become a staple in our community. It is an important day for Kacy and for finding a cure. But as I (Kacy's dad) like to say, more than anything, the day is about HOPE. When you choose HOPE anything is possible. The support you all provide year after year gives us hope….hope for better treatments….hope for a cure…. Thank you!

CNBC Ratings as a Leading Indicator?

This may be the most unique candidate for a leading indicator I’ve run across in a long time. A leading indicator is defined as a measurable economic factor that changes before the economy starts to follow a particular pattern or trend. You may have heard of an inverted yield curve predicting recessions or the number of building permits applied for predicting a housing boom or bust.

This may be the most unique candidate for a leading indicator I’ve run across in a long time. A leading indicator is defined as a measurable economic factor that changes before the economy starts to follow a particular pattern or trend. You may have heard of an inverted yield curve predicting recessions or the number of building permits applied for predicting a housing boom or bust.

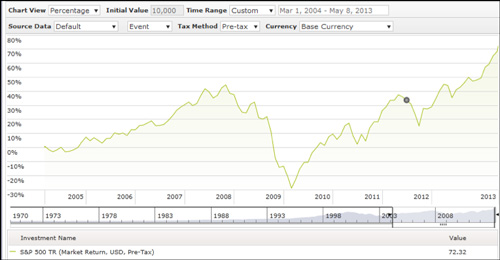

How about CNBC viewership predicting the next stock market boom or bust? Below is a chart showing Nielson Ratings for CNBC over the last eight years. The last time their ratings were this low was 2005 when markets had stablized after the tech bubble burst and we had enjoyed a couple of years of good returns. Sound familiar?

As you can see in the chart below of the S&P 500 total returns, 2005 was the start of some very nice returns which continued for the next few years. Could the low viewer ratings be a potential indicator that the returns we have experienced since 2009 are just the beginning? As returns accelerated toward the market peak in 2007 so did CNBC’s ratings into 2007.

Data from Morningstar

As individual investors start to jump on the band wagon of a bull market run, they become more interested in what is happening to their money and thus turn on the news.

There are many reasons investors could be choosing not to watch the channel now:

- Investors have been lulled into a sense of security about market returns and aren’t concerned about current events

- Many are not actually invested in the markets; therefore, they do not care

- Investors are finding their information elsewhere

- They have grown tired of the sensationalizing the network does to try to get better ratings (which is actually my main reason for not watching)

Assuming investors aren’t watching anymore because of one of the first two reasons, then this could be a very good indicator of what is to come, potential positive returns as more individuals put money back to work in the markets.

It is too bad there isn’t much historical data to determine if this is, indeed, a good stock market indicator but it is definitely something from CNBC that is much more interesting to follow than their overly dramatic, TV personalities!

Angela Palacios, CFP® is the Portfolio Manager at Center for Financial Planning, Inc. Angela specializes in Investment and Macro economic research. She is a frequent contributor to Money Centered as well as investment updates at The Center.

Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary. Past performance may not be indicative of future results.

Why is 2020 So Significant to Boomers and Their Children?

We’re not talking about 20/20 the news program, or about your vision. We’re talking about the startling statistic released by the Alzheimer’s Association that by the year 2020, there will be 20 million baby boomers with Alzheimer’s disease. In case you’re counting, that will be nearly 1 out of every 3 baby boomers that have Alzheimer’s or a related dementia. The cost of care will be a huge concern for these boomers and their families (according to AARP, the current average cost to care for someone with Alzheimer’s is $56,800 annually), among the many issues that will arise.

We’re not talking about 20/20 the news program, or about your vision. We’re talking about the startling statistic released by the Alzheimer’s Association that by the year 2020, there will be 20 million baby boomers with Alzheimer’s disease. In case you’re counting, that will be nearly 1 out of every 3 baby boomers that have Alzheimer’s or a related dementia. The cost of care will be a huge concern for these boomers and their families (according to AARP, the current average cost to care for someone with Alzheimer’s is $56,800 annually), among the many issues that will arise.

If you are a boomer, here are the top 3 things you can do to prepare for this risk:

- Put Together a Team of Professionals – Start with a Certified Financial Planner™, who can help you plan ahead for the financial risks. This will involve simplifying accounts, managing your assets, and helping you plan for your financial future with your personal preferences in mind. Your financial planner will help you to put together a team of the additional professionals you may need and will bring on additional team members, as needed, along the way.

- Make Sure Your Legal Documents are Up-To-Date – We are talking here about your wills, possibly a trust, but most importantly Durable Powers of Attorney. All individuals should have two durable powers of attorney – one for Health Care and the other for General/Financial affairs. These Powers of Attorney will be invaluable if you ever need someone to make health care or financial decisions when you are unable to make them yourself.

- Get Your Financial Life in Order and Document – Not only is it a good practice to take inventory of what you have and where it is, but it is also (and equally) important to document these items and indicate where and who to contact if there are questions. Documenting investment accounts, insurance policies, legal documents, former employer benefits, etc., will be invaluable to family members or close friends who may need to assist you with your financial affairs in the future. Click Here for our Personal Record Keeping document that can serve as a guideline for this purpose.

While an Alzheimer’s diagnosis is not something any of us want to think about, it is better to plan ahead so that your financial life will be handled as you intend, rather than leaving the burden of making those decisions to your family when you might not be able to communicate your wishes.

Sandra Adams, CFP® is a Financial Planner at Center for Financial Planning, Inc. Sandy specializes in Elder Care Financial Planning and is a frequent speaker on related topics. In 2012 and 2013, Sandy was named to the Five Star Wealth Managers list in Detroit Hour magazine. In addition to her frequent contributions to Money Centered, she is regularly quoted in national media publications such as The Wall Street Journal, Research Magazine and Journal of Financial Planning.

Five Star Award is based on advisor being credentialed as an investment advisory representative (IAR), a FINRA registered representative, a CPA or a licensed attorney, including education and professional designations, actively employed in the industry for five years, favorable regulatory and complaint history review, fulfillment of firm review based on internal firm standards, accepting new clients, one- and five-year client retention rates, non-institutional discretionary and/or non-discretionary client assets administered, number of client households served.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing information is accurate or complete. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James. You should discuss any tax or legal matters with the appropriate professional.

Talking Technology in Texas at the Raymond James Conference

With the destination of Grapevine, Texas, eleven team members flew south to attend the Raymond James National Conference April 22-25. The four-day event welcomed over 3,000 participants from across the nation, fostering both professional and personal development through a variety of learning sessions presented by both peer advisors and specialized industry experts.

With the destination of Grapevine, Texas, eleven team members flew south to attend the Raymond James National Conference April 22-25. The four-day event welcomed over 3,000 participants from across the nation, fostering both professional and personal development through a variety of learning sessions presented by both peer advisors and specialized industry experts.

The Center proudly led a conference Top Advisor Session. These sessions are well attended by peers looking to share their experiences and ideas for success. Tim Wyman, CFP®, JD and Melissa Joy, CFP® led a discussion about investing in your staff to build a great business. Melissa Joy also presented with a panel of financial advisors during a pre-conference Investment Management module. The topic was "The Great Rotation" from bonds into stocks.

In addition to attending Top Advisor Sessions, Center team members sat in on multiple sessions covering advanced investment strategies, retirement planning, practice management and marketing. These educational sessions provided the opportunity to earn continuing education credits and also sparked new ideas to best serve our clients.

One area of growth highlighted at this year’s national conference was technology. Raymond James and Center for Financial Planning are making investments in cutting edge technology to the advantage of both Center clients and the advising teams.

Melissa Joy comments, "The National Conference offers the opportunity to share ideas and learn from our peers that just can't be replicated across the miles. There's alot of idea-sharing, hard work, and just as much socializing and fun. What's not to love?"

Members of our Center team in attendance included: Sandy Adams CFP®, Dan Boyce CFP®, Matt Chope CFP®, Melissa Cyrus, Client Service Associate, Marilyn Gunther CFP®, Julie Hall, Melissa Joy CFP®, Angela Palacios CFP®, Laurie Renchik CFP®, and Tim Wyman CFP®, JD.

Happy Centerversary

While the Center celebrates 28 years serving our clients, our newest Client Service Associate, Melissa Cyrus, is also celebrating a milestone … her first “Centerversary” with us.

While the Center celebrates 28 years serving our clients, our newest Client Service Associate, Melissa Cyrus, is also celebrating a milestone … her first “Centerversary” with us.

We are proud to take a moment and recognize Melissa. It was a year ago May 14th that she added her enthusiasm to our team. Melissa said the momentous occasion sort of snuck up on her, telling us, “It’s been a year already? Hard to believe … it went by so fast! I feel very fortunate to be working at such a wonderful place surrounded by such awesome people. It sure makes the time fly.”

Guess Melissa just proved the old adage Time flies when you’re having fun. And all that wisdom from someone who has only been around for a year. Just wait to see what she has to say on her 10th Centerversary!

Is Your Portfolio Off to the Races?

We just got to enjoy what has been called “The Greatest Two Minutes in Sports.” I have always been a fan of the Kentucky Derby, the horses, the outrageous hats, wondering who is wearing the hats, and a blanket of roses. I’ve had the privilege of actually going down to Louisville to watch but I have never been part of the glamorous, hat-wearing crowd. We’ve always watched from the infield, though “watch” is a loose term. It is more like standing on your tip toes to see a blur of horses run by you for about one-tenth of a second and then return to drinking your mint julep. But it is fun nonetheless.

We just got to enjoy what has been called “The Greatest Two Minutes in Sports.” I have always been a fan of the Kentucky Derby, the horses, the outrageous hats, wondering who is wearing the hats, and a blanket of roses. I’ve had the privilege of actually going down to Louisville to watch but I have never been part of the glamorous, hat-wearing crowd. We’ve always watched from the infield, though “watch” is a loose term. It is more like standing on your tip toes to see a blur of horses run by you for about one-tenth of a second and then return to drinking your mint julep. But it is fun nonetheless.

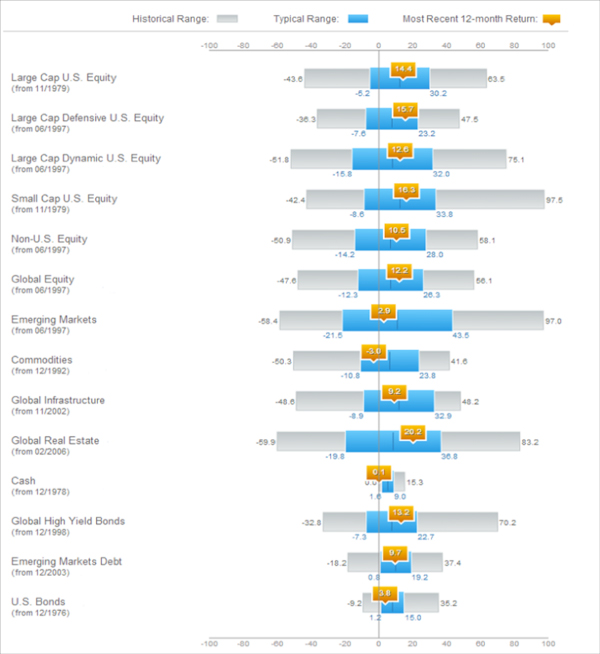

This year the market has felt a lot like we have been off to the races. It has been one of the strongest starts to the year this decade. Is it too much too fast? A new chart put out by Russell Investments says maybe not.

For additional disclosure and interpretive guidance on this chart, please click on the following link: http://www.russell.com/Helping-Advisors/Markets/acd.aspx?d=t

How to interpret the chart:

- The gray bar is the full range of 1 year returns the asset class has experienced throughout history

- The blue portion of the bar is where returns fall most of the time (68%)

- The number highlighted in orange is where returns fell for the 12 months that ended as of March 31st, 2013

Even with the strong returns, as of recently, most indexes are still hovering near “middle of the road” returns for the past 12 months. So perhaps it hasn’t been too much too quickly.

If you are seeking some advice on an appropriate strategy for your portfolio, put the odds in your favor and contact your Financial Planner today!

Angela Palacios, CFP®is the Portfolio Manager at Center for Financial Planning, Inc. Angela specializes in Investment and Macro economic research. She is a frequent contributor to Money Centered as well asinvestment updates at The Center.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website’s users and/or members.

Planning for Marriage May Include a Prenuptial Agreement

If an “I do” is in your near future, you need to make another commitment … this one to your financial planner. Before all the wedding planning and honeymoon booking are complete, a conversation with your financial planning team is also recommended to take a look at how marriage will impact your financial situation. Two people coming together with unique financial positions can create a number of financial issues to think about and plan for prior to entering this new chapter in life.

If an “I do” is in your near future, you need to make another commitment … this one to your financial planner. Before all the wedding planning and honeymoon booking are complete, a conversation with your financial planning team is also recommended to take a look at how marriage will impact your financial situation. Two people coming together with unique financial positions can create a number of financial issues to think about and plan for prior to entering this new chapter in life.

While prenuptial agreements aren’t for everyone, they are important planning tools especially if you or your future spouse have substantial assets, will receive a future inheritance, or have children from a previous marriage.

A prenuptial agreement typically provides direction in the following areas:

- Assets and liabilities – who brings what into the union

- Contributions of each partner – will there be special considerations

- Estate Planning – who gets what at the death of either spouse

- Division of property – when a couple decides to dissolve their marriage

More importantly the prenuptial document creates an understanding between partners and a roadmap for conducting financial affairs together. It determines how the assets and debts will be shared. It spells out how children from a previous marriage or relationship will inherit and it addresses the financial needs of the survivor in the case of death.

While talking with an attorney about a prenuptial agreement can be a stressful and touchy topic for many couples, the many beneficial aspects are worthy of consideration.

Laurie Renchik, CFP®, MBA is a Senior Financial Planner at Center for Financial Planning, Inc. In addition to working with women who are in the midst of a transition (career change, receiving an inheritance, losing a life partner, divorce or remarriage), Laurie works with clients who are planning for retirement. Laurie was named to the 2013 Five Star Wealth Managers list in Detroit Hour magazine, is a member of the Leadership Oakland Alumni Association and in addition to her frequent contributions to Money Centered, she manages and is a frequent contributor to Center Connections at The Center.

Five Star Award is based on advisor being credentialed as an investment advisory representative (IAR), a FINRA registered representative, a CPA or a licensed attorney, including education and professional designations, actively employed in the industry for five years, favorable regulatory and complaint history review, fulfillment of firm review based on internal firm standards, accepting new clients, one- and five-year client retention rates, non-institutional discretionary and/or non-discretionary client assets administered, number of client households served.

You should discuss any tax or legal matters with the appropriate professional.