Oil Trends Could Free U.S.

Have you noticed the price at the pump lately? The cost of gas has gone down and we very well could be at an energy cost plateau for some time. This stability in energy prices removes one of the many potential shocks that can combat the economic system.

Have you noticed the price at the pump lately? The cost of gas has gone down and we very well could be at an energy cost plateau for some time. This stability in energy prices removes one of the many potential shocks that can combat the economic system.

According to the Energy Information Administration, the United States will consume total of 7 billion barrels a year (22 Million barrels a day) -- about 22% of total world petroleum consumption -- in 2013. An analyst that I spoke with recently, who has spent his entire career of over 40 years in the energy space, believes that America could be energy independent by 2020 and prices could remain fairly stable until 2040. But there are so many moving parts it’s really too difficult to tell exactly.

On the supply side of the equation, at current market prices the US (in blue below) has just become the second largest global producer surpassing Russia (tracked in brown) for total liquid fuel production in the world.

Consider some other positive outcomes:

- Chemical plants are being built in the US again for the first time in 25 years because of oil shale. They are building them with cheap financing, cheap energy and cheap labor right near the shale. US Chemical companies are the low cost producers in the world now.

- The International Energy Agency said recently that the US is on track to becoming the leading global producer within the next decade.

- Demand has waned as well due to higher prices and efficiencies as people grow more conscientious.

- The best outcome of all would be if the US becomes less dependent on OPEC and their “Oil Weapon” which has been dangled ominously over us for 3 decades. We very well could be in greater control of our supply shocks for a decade or two, maybe much longer if we use this time to develop alternative energy sources that could sustain us after the shale runs out.

Matthew E. Chope, CFP ® is a Partner and Financial Planner at Center for Financial Planning, Inc. Matt has been quoted in various investment professional newspapers and magazines. He is active in the community and his profession and helps local corporations and nonprofits in the areas of strategic planning and money and business management decisions. In 2012 and 2013, Matt was named to the Five Star Wealth Managers list in Detroit Hour magazine.

Five Star Award is based on advisor being credentialed as an investment advisory representative (IAR), a FINRA registered representative, a CPA or a licensed attorney, including education and professional designations, actively employed in the industry for five years, favorable regulatory and complaint history review, fulfillment of firm review based on internal firm standards, accepting new clients, one- and five-year client retention rates, non-institutional discretionary and/or non-discretionary client assets administered, number of client households served.

The information contained in this report does not purport to be a complete description of the markets or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of Raymond James. Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

Curtain Call

The Center's Team enjoys sharing their knowledge with the press to help stories come to life, share facts and bring important topics to the forefront. We are also honored when we are recognized by media and publications for our work and service to our profession. Here's what's new:

The Center's Team enjoys sharing their knowledge with the press to help stories come to life, share facts and bring important topics to the forefront. We are also honored when we are recognized by media and publications for our work and service to our profession. Here's what's new:

Center Recognized as one of Michigan's Healthiest Employers

The Center was recognized as one of Michigan’s Healthiest Employers for the second consecutive year. Honorees were chosen from employers across Michigan whose policies and programs promote a healthy workforce. The Center took honors in the Metro Detroit Region competing with companies whose workforce size is between 5 and 99 employees.

The project was sponsored by Priority Health; data was collected by Indianapolis-based Healthiest Employer LLC. Crain's Detroit Business and MiBiz produced this promotional supplement as media sponsors of the project.

Energy's Shock Absorbers to the Economy

Know much about the natural gas trapped in shale? You don’t need to, but the abundance of this natural resource may be one of the things our economy needs. The US economy could very well have shock absorbers for a while. These colored areas on the map below are energy resources that could lead to our energy independence for decades to come.

Know much about the natural gas trapped in shale? You don’t need to, but the abundance of this natural resource may be one of the things our economy needs. The US economy could very well have shock absorbers for a while. These colored areas on the map below are energy resources that could lead to our energy independence for decades to come.

None of us at The Center are environmentalist, geologist or oil experts; we are also are not economists. But we’ve been doing our homework on shale as we try to understand what is going on in the economy. With oil prices at much higher levels than most of history, shale gas can allow for a less conventional technology to be used to recover energy.

Horizontal drilling and hydrofracking technology breaks open shale rock by pumping high-pressure fluids into the ground, making shale gas abundantly accessible. According to some experts, the United States alone has over a 100-year supply of this unconventional energy source.

Remember all of the buzz about running out of natural resources on the planet? Just a decade ago we were consumed by the fact that we would be out of energy to move us around the planet and heat our homes in the not too distant future. But when you move the dial in price up a few notches all kinds of things came on line meeting demand with new supply.

Matthew E. Chope, CFP ® is a Partner and Financial Planner at Center for Financial Planning, Inc. Matt has been quoted in various investment professional newspapers and magazines. He is active in the community and his profession and helps local corporations and nonprofits in the areas of strategic planning and money and business management decisions. In 2012 and 2013, Matt was named to the Five Star Wealth Managers list in Detroit Hour magazine.

Five Star Award is based on advisor being credentialed as an investment advisory representative (IAR), a FINRA registered representative, a CPA or a licensed attorney, including education and professional designations, actively employed in the industry for five years, favorable regulatory and complaint history review, fulfillment of firm review based on internal firm standards, accepting new clients, one- and five-year client retention rates, non-institutional discretionary and/or non-discretionary client assets administered, number of client households served.

The information contained in this report does not purport to be a complete description of the markets or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James. Investing in the energy sector involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

Thanksgiving Gratitude

Gratitude comes in many forms. There are the big and obvious and then there are the small or sometimes overlooked. In this season of Thanksgiving, the team at The Center pay tribute to a few of our favorite things. Happy Thanksgiving!

Investment Commentary - 4th Quarter 2013

What goes up... 2013 has been a year of extremes. The stock market[i] has produced dramatically positive total returns. Meanwhile bonds[ii] are suffering their worst losses in almost 15 years. Whether rate rise result in the advent of a new “rising rate regime” where returns have more and more headwind over time is yet to be determined. Meanwhile, stock returns have been so strong (north than 25% as of November 19th) that market watchers are increasingly debating the sustainability of continued positive returns.

Here are full asset class returns through the 3rd quarter. Of note: we have marked the five-year anniversary of Lehman Brother’s collapse – an infamous period in American market history and also a reminder of how far portfolios and personal balance sheets have come since that time.

Economic Update

The extremity of returns is being accompanied by more unexceptional economic growth. While a desirable recovery growth rate might be 4%, the real gross domestic product was most recently measured at 2.8%[iii]. What growth there is has come without a hiring bonanza that Main Street and the Fed are craving; unemployment continues to get better but at an unimpressive pace. There are, however, quite a few bright spots in the economy.

What are the bright spots?

- Always a critical factor to economic growth, housing prices are coming off a strong year of recovery with a tight supply and rising demand. Affordability of home ownership still seems to be reasonable due to low borrowing rates for those who can qualify and rising rents. While we don’t think the high pace of recovery can be sustained, we do think the housing picture will continue to look more positive.

- Corporate profitability continues to be near historic highs. Companies, like households, did a lot of belt-tightening over the last five years. The question today is when will companies start to spend some of their cash war chest they’ve accumulated on capital expenditures or hiring?

- Surprises have come to the economy through an energy renaissance that is welcomed by US capital markets but reviled by those concerned with environmental impact of shale drilling. An underreported note is that new energy production is accompanied by continued muted demand which may be the result of slower recovery but also changes in behavior through more efficient energy usage. We will continue to keep our eyes on this development for potential positive feedback to housing and US manufacturing.

- Foreign markets have been less cheers and more jeers for much of the past few years. A recurrence of growth in Europe and introduction of new stimulus in Japan has meant that investors saw better returns[iv] in 2013. We still see attractive valuations relative to US stocks and bonds in some instances.

Valuations Today

Rather than taking a victory lap, investors are asking what’s around the corner and whether the strong returns of 2013 might be leading into a new bubble. Stock market valuations (measures of whether stocks are more or less expensive) seem to be in the fair value range – trading around a price-earnings ratio between fifteen and sixteen times[v]. We agree that what goes up may at some point come down – there has been very little pull-back in the US market this year and at some point, bigger drawdowns are probably likely.

On the plus side, much of the 2013 sequestration may be behind us, depending on the results of Washington DC negotiations on the budget and debt ceiling. Also, many have kept cash on the sidelines waiting for drawbacks to occur so they can buy at lower prices. We think this “cash on the sideline” may be part of the reason drawbacks have been so shallow this year and there is more cash where that came from. When you couple that cash with the huge pile of bonds people have purchased in the past five years with very low prospects for future return, there may be more fuel for the stock market fire.

Portfolio Construction Today

We have continued to underweight core bonds in investment portfolios, overweighting multi-sector bond diversifiers and equities in their stead. While reduced in our allocations, we feel there is an enduring role for bonds in many personal investment portfolios. We maintain a neutral weighting to US stocks, have increased our underweight in international stocks to neutral, and maintained an overweight to flexible-tactical managers who can choose between asset classes based upon the changing dynamics of markets. At all times, we recommend that you maintain a rebalancing process and invest with attention to anticipated liquidity needs, tax situations, etc.

We continue to ask you to stick with the discipline of diversified, balanced investing. In some years, you may ask us why we didn’t hunker down in cash because markets declined. At other times, you might be kicking yourself because a pure stock portfolio is up north of 25% and your diversified returns seem less impressive. Our experience leads us to recommend a broadly diversified portfolio to meet your financial goals and objectives. Thank you for your trust in letting us work with you to meet those goals.

On behalf of everyone at The Center,

Melissa Joy, CFP®

Partner, Director of Investments

Melissa Joy, CFP®is Partner and Director of Investments at Center for Financial Planning, Inc. In 2011 and 2012, Melissa was honored by Financial Advisor magazine in the inaugural Research All Star List. In addition to her frequent contributions to Money Centered blogs, she writes frequent investment updates at The Center and is regularly quoted in national media publications including The Chicago Tribune, Investment News, and Morningstar Advisor.

Financial Advisor magazine's inaugural Research All Star List is based on job function of the person evaluated, fund selections and evaluation process used, study of rejected fund examples, and evaluation of challenges faced in the job and actions taken to overcome those challenges. Evaluations are independently conducted by Financial Advisor Magazine.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Melissa Joy, CFP® and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. This information is not intended as a solicitation or an offer to buy or sell any investment referred to herein. Investments mentioned may not be suitable for all investors. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices generally rise. International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility. Investing in emerging markets can be riskier than investing in well-established foreign markets. Diversification and asset allocation do not ensure a profit or protect against a loss. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results.

[i] As measured by the S&P 500 index

[ii] As measured by the BarCap Aggregate Bond Index

[iii] US Department of Commerce Bureau of Economic Analysis

[iv] As measured by MSCI EAFE NR USD

[v] Source: JPMorgan Weekly Market Recap 11/18/13

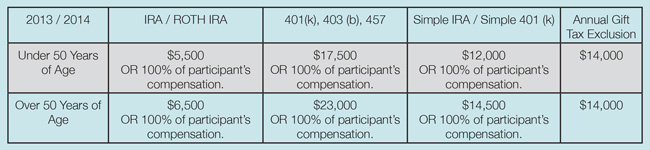

2013/2014: Key Financial Planning Numbers

As we approach year-end (yes, already!), it is time to determine what needs to be done to reach your 2013 financial goals AND start preparing for 2014. The 2014 Contribution and Annual Gifting Limits were recently released, and they remain unchanged from 2013 limits. Here is summary of the existing limits for your reference.

As we approach year-end (yes, already!), it is time to determine what needs to be done to reach your 2013 financial goals AND start preparing for 2014. The 2014 Contribution and Annual Gifting Limits were recently released, and they remain unchanged from 2013 limits. Here is summary of the existing limits for your reference.

If you haven’t completed your retirement plan contributions or gifting for 2013, find time to connect with your financial planner to make sure you meet the appropriate deadlines. And make plans now to coordinate with your planner to set your 2014 goals!

Sandra Adams, CFP® is a Financial Planner at Center for Financial Planning, Inc. Sandy specializes in Elder Care Financial Planning and is a frequent speaker on related topics. In 2012 and 2013, Sandy was named to the Five Star Wealth Managers list in Detroit Hour magazine. In addition to her frequent contributions to Money Centered, she is regularly quoted in national media publications such as The Wall Street Journal, Research Magazine and Journal of Financial Planning.

Five Star Award is based on advisor being credentialed as an investment advisory representative (IAR), a FINRA registered representative, a CPA or a licensed attorney, including education and professional designations, actively employed in the industry for five years, favorable regulatory and complaint history review, fulfillment of firm review based on internal firm standards, accepting new clients, one- and five-year client retention rates, non-institutional discretionary and/or non-discretionary client assets administered, number of client households served.

Social Security Increases Benefits by 1.5% for 2014

The Social Security Administration has announced a cost of living adjustment (COLA) to recipients’ monthly Social Security and Supplemental Security Income (SSI) benefits. More than 57 million Americans will see the 1.5% increase in their payments beginning on December 31, 2013.

The Social Security Administration has announced a cost of living adjustment (COLA) to recipients’ monthly Social Security and Supplemental Security Income (SSI) benefits. More than 57 million Americans will see the 1.5% increase in their payments beginning on December 31, 2013.

The increase is tied to the Consumer Price Index for Urban Wage Earners and Clerical Workers and was put in place to ensure the purchasing power of these benefits isn’t eroded by inflation. The increase is just less than the 1.7% jump that beneficiaries saw in 2013.

Keep in mind, all federal benefits must be direct deposited. So if you haven’t already started receiving benefits, you need to establish electronic transfers to your bank or financial institution.

"The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete."

Compartmentalize Your Finances

Love Starbucks? A lot of us do, but try answering this question I recently heard posed by a behavioral finance professor: “Would you be more inclined to order a latte that was advertised as 95% fat free, or one labeled 5% fat?” The two $5 drinks are the exact same, however, I would venture to say 99.9% of people (including me) would choose the drink that was advertised as 95% fat free. Perception is as powerful force in the coffee world as it is in the investment world. Perception can work against you when it comes to savings or it can fuel you. Much of that depends on how you compartmentalize.

Love Starbucks? A lot of us do, but try answering this question I recently heard posed by a behavioral finance professor: “Would you be more inclined to order a latte that was advertised as 95% fat free, or one labeled 5% fat?” The two $5 drinks are the exact same, however, I would venture to say 99.9% of people (including me) would choose the drink that was advertised as 95% fat free. Perception is as powerful force in the coffee world as it is in the investment world. Perception can work against you when it comes to savings or it can fuel you. Much of that depends on how you compartmentalize.

The Behavioral Finance of Compartmentalizing

So what does it mean to compartmentalize? Simply put it is separating two or more things from each other. In personal finance, separating certain accounts to have individual goals can have a tremendous effect on the likelihood of savings and overall success of the individual’s financial plan. For instance, one of the most important pieces of a financial plan is maintaining an adequate emergency fund for the dreaded unknowns – such as job loss, unexpected home improvements, medical expenses, etc. (The Center team usually recommends that clients maintain 3 – 12 months of living expenses in a cash account that is not subject to market risk).

Establish Separate Accounts

If you find yourself constantly transferring funds from your savings to your checking account each month because they are at the same institution and the ease of the transfer is just to easy to resist, consider making a change! Why not open a savings account at a completely different financial institution and maintain your emergency fund there, knowing this money cannot be touched except for an emergency.

Give it a Label

Many banks now allow you to name an account and personalize it. So instead of seeing your account being titled as “Savings” each time you log in, it would read “Emergency fund – don’t touch!” Adding that “name” or “purpose” to the account has been proven to dramatically increase savings levels and decrease the likelihood of spending out of the account.

Keep it Simple

Separating accounts for each individual goal in retirement, however, is pretty unrealistic. Who wants to have 20 different IRA accounts? At The Center, we like to keep things simple to stay organized and on track. However, our advisors do encourage clients to compartmentalize in their minds when looking at their overall stock/bond/cash allocation to stay focused and not lose track of the purpose of each type of asset that is held within the portfolio. Each “bucket” of funds has a purpose and impact on the total portfolio and it is The Center’s job as your trusted advisor team to help you fill each one and utilize them to their maximum potential.

Nick Defenthaler, CFP® is a Support Associate at Center for Financial Planning, Inc. Nick currently assists Center planners and clients, and is a contributor to Money Centered and Center Connections.

The information contained in this report does not purport to be a complete description of the securities, markets or developments referred to in this material. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Any opinions are those of Center for Financial Planning, Inc., and not necessarily those of RJFS or Raymond James.

We're Sorry, This Page is No Longer Available

Checkout our current blog posts HERE. See you there!