Tax Reform Series: Changes to the Mortgage Interest Deduction (including home equity loans/LOC implications)

Contributed by: Laurie Renchik, CFP®, MBA

The Tax Cuts and Jobs Act (TCJA) is now officially law. We at The Center have written a series of blogs addressing some of the most notable changes resulting from this new legislation. Our goal is to be a resource to help you understand these changes and interpret how they may affect your own financial and tax planning efforts.

Washington has been busy and after many twists and turns sweeping tax reform was signed into law on December 22, 2017. There are key changes for homeowners regarding the mortgage and home equity line of credit (HELOC) interest deductions.

Mortgage

If you own a home, mortgage interest is still deductible. The debt cap of deductibility, however, has been lowered. The new cap limits interest deductibility to the first $750,000 of debt principal. Debt principal refers to acquisition indebtedness or loans used to acquire, build, or substantially improve a primary residence. The new $750,000 cap is a reduction from $1,000,000 and an additional $100,000 of home equity debt.

The reduction to $750,000 expires December 31, 2025 and reverts back to $1,000,000 beginning in 2026.

Mortgage debt incurred before December 15, 2017 is grandfathered under the $1,000,000 cap

In the future, a mortgage refinance for debt incurred prior to December 15, 2017 will retain the $1 million debt limit (but only for the remaining debt balance and not any additional debt). In addition, any houses that were under a binding written contract by December 15th to close on a principal residence purchased by January 1, 2018 (and actually close by April 1st) will be grandfathered.

Home Equity Line of Credit (HELOC)

Home equity lines of credit give homeowners the ability to borrow or draw money using equity in the home as collateral. New restrictions mean that home equity loan interest is not necessarily eligible for a deduction.

While you may have read that interest on HELOC’s is no longer deductible, this is only if the loans are cash out or for purposes other than home purchase or improvement. It’s important to note that deductibility is not based on whether the loan is a home equity loan or home equity line of credit. Instead, the determination is based on how the proceeds are used.

If the money is used to consolidate debt, pay for college or used for any other personal spending not associated with home acquisition or substantial improvement, the interest is not deductible; without grandfathering.

Interest on a HELOC up to the total $750,000 cap that is used to build an addition or substantially improve the home is deductible for taxpayers that itemize.

We are here to assist in any way we can. This summary of mortgage and HELOC interest deductibility changes highlights key areas to keep in mind for 2018 tax planning. If you have any questions regarding your personal situation, don’t hesitate to contact us.

Laurie Renchik, CFP®, MBA is a Partner and Senior Financial Planner at Center for Financial Planning, Inc.® In addition to working with women who are in the midst of a transition (career change, receiving an inheritance, losing a life partner, divorce or remarriage), Laurie works with clients who are planning for retirement. Laurie is a member of the Leadership Oakland Alumni Association and is a frequent contributor to Money Centered.

Check out our other Tax Reform articles:

Changes to Federal Income Tax Brackets

Changes to Standard Deduction, Personal Exemption, Misc. Deductions, and the Child Credit

Changes to Investments and the Financial Market

Changes to State and Local Tax Deduction

Changes to Estate Tax Planning in 2018 and Beyond

Changes to Charitable Giving and Deductions

Changes to Medical Deductions

Changes to Business & Corporate Tax, and Pass-Through Entities

The information contained in this blog does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Laurie Renchik and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. This material is being provided for information purposes only. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Please note, changes in tax laws may occur at any time and could have a substantial impact upon each person's situation. While we are familiar with the tax provisions of the issues presented herein, as Financial Advisors of RJFS, we are not qualified to render advice on tax or legal matters. You should discuss tax or legal matters with the appropriate professional. Raymond James Financial Services and your Raymond James Financial Advisors do not solicit or offer residential mortgage products and are unable to accept any residential mortgage loan applications or to offer or negotiate terms of any such loan. You will be referred to a qualified Raymond James Bank employee for your residential mortgage lending needs.

Tax Reform Series: Changes to State and Local Income Tax

Contributed by: Matthew E. Chope, CFP®

The Tax Cuts and Jobs Act (TCJA) is now officially law.

We at The Center have written a series of blogs addressing some of the most notable changes resulting from this new legislation. Our goal is to be a resource to help you understand these changes and interpret how they may affect your own financial and tax planning efforts.

The original proposals for tax reform would have completely eliminated any deductions for taxes paid to a state or local government, including local property taxes.

“State And Local Tax” (SALT) provision varied, and controversially was projected to have a disproportionate impact on states with big cities with high state and local tax rates (like New York, California, and Maryland have some of the highest state income tax rates, and therefore the higher state income tax deductions). Many people in these states are considering moving to lower taxed states due to this tax law change.

However, in the final version of the Tax Cuts and Jobs Act of 2017, households will be given the option to deduct their combined state and local property and income taxes, but only up to a cap of $10,000. Notably, it is a $10,000 limit on the combined total of property and income taxes, not $10,000 each! The $10,000 limit applies for both individuals and married couples (which is an indirect marriage penalty for high-income couples), and is reduced to $5,000 for those who are married filing separately.

In addition, to prevent households from attempting to maximize their state and local tax deductions in 2017 before the cap takes effect in 2018, the new rules explicitly stipulate that any 2018 state income taxes paid by the end of 2017 are not deductible in 2017 and instead will be treated as having been paid at the end of 2018. However, this restriction applies only to the prepayment of income taxes (not to property taxes), and applies only to actual 2018 tax liabilities.

Matthew E. Chope, CFP ® is a Partner and Financial Planner at Center for Financial Planning, Inc.® Matt has been quoted in various investment professional newspapers and magazines. He is active in the community and his profession and helps local corporations and nonprofits in the areas of strategic planning and money and business management decisions.

Check out our other Tax Reform articles:

Changes to Federal Income Tax Brackets

Changes to Standard Deduction, Personal Exemption, Misc. Deductions, and the Child Credit

Changes to Investments and the Financial Market

Changes to Mortgage Interest Deduction (including Home Equity Loans and LOC Implications)

Changes to Estate Tax Planning in 2018 and Beyond

Changes to Charitable Giving and Deductions

Changes to Medical Deductions

Changes to Business & Corporate Tax, and Pass-Through Entities

This information has been obtained from sources deemed to be reliable but its accuracy and completeness cannot be guaranteed. Neither Raymond James Financial Services nor any Raymond James Financial Advisor renders advice on tax issues, these matters should be discussed with the appropriate professional.

4th Quarter Investment Commentary

Contributed by: Angela Palacios, CFP®, AIF®

If you're interested in attending our Annual Client Investment Review Event at the Great Lakes Culinary Center on February 20th at 11:30am, please register here. If you can't attend, consider our Investment Review Webinar on Tuesday, February 20th at 1PM, please register here.

2017 in Review and Outlook for 2018

Fidget spinners, bitcoins, and Trump. If you have young children, you could not miss the fidget spinner craze that hit in April of this year. This simple toy rotates on a ball bearing. By the time I got around to getting my 10-year-old child one in mid-May for her birthday, they were SO yesterday. My major parenting fail of 2017! In the financial world, another mania took over. Bitcoin, while not brand new, certainly gained a ton of traction this year as an alternative cryptocurrency. The price of Bitcoin surged from below $1,000 per bitcoin to more than $19,000! This paved the way for many other cryptocurrencies (Bitcoin competitors) making their way to center stage with astonishing returns also. If you want more information, check out this blog Talking Bitcoin, written by Nick Boguth earlier this year.

The news cycle has also revolved around President Trump this year. While failing to overhaul Obamacare or U.S. trade policy, he was successful in getting some long-anticipated tax reform through to round out his first full year as our President.

The past year turned out to be far more bullish than many expected. International and emerging markets outpaced U.S. markets. Growth investing beat value investing, while Bonds returned little more than their yield. 2018 has a tough act to follow!

Tax Reform and its Impact on the Economy

Although the tax cut seems to favor corporations, much of the net tax cuts are going to the individual. The tax act should increase after-tax income for most American households both directly, through lower personal taxes, and indirectly, through the impact of higher dividends and stock prices resulting from the cut in corporate taxation. As people spend more, GDP should increase and unemployment should continue to decrease possibly causing the wage inflation we have been waiting for. This chart shows the level of unemployment (gray line) and the level of wage inflation the (blue line). The dotted lines for each color are average levels. You can see that both are below their average levels. Usually when unemployment is below average the wage growth line rises back to its long-term average level, but this has not happened yet. Retiring higher-paid baby boomers are being replaced with lower-paid millennials entering the workforce and this has had a significant downward pressure on wages keeping it well below its long-term average growth rate.

If wages finally start to increase, this could cause inflation to pick up somewhat. This would be a positive influence on the stock market in the short run.

Tax Reform and its Impact on Equities

Looking at the influence tax reform will have on corporations, smaller companies will likely see a more impactful tax benefit with the corporate tax rate cut to 21% (which consequently is just below the average of the countries in the OECD or the organization for economic co-operation and development). Currently, small cap companies pay the highest tax rates.

After a strong year for equities, the impact of tax reform could be more muted than you might think as the markets already anticipated some corporate tax reform passing. Quite often, equity prices factor these events in long before the pen hits the paper.

Tax Reform and its Impact on Fixed Income

Bond markets will have mixed implications from tax reform. Companies that over-levered and don’t have strong positive cash flow will be penalized. This new law places limits on the interest that corporations can deduct. This will likely affect companies who are issuers of high yield debt negatively. While companies investing for growth by making capital expenditures will be rewarded as, they are now allowed to expense a larger amount of these capital expenditures.

Municipal bonds should fare well next year with limits being placed on state tax and property tax deductions, especially in states with higher tax rates. Other opposing forces could affect supply within the municipal bond market in the coming year from tax reform. The law eliminates the issuance of advance refunding bonds that are used to retire old debt. These bonds help boost supply by 10-20% each year in the municipal bond market. On the flip side, corporations will be less incentivized to hold onto municipal debt as their tax rates have been slashed. If they sell these bonds into the market place that could increase supply, which could lower bond prices. However, these two forces may cancel each other out. It looks like the elimination of advance refunding bonds will likely offset any boost in supply from corporations selling.

Interest rates on the rise

The Fed raised short-term interest rates again in December, which was highly anticipated. They are planning to continue with three more rate hikes in 2018. The bond market already anticipates these rate hikes, which means they should be priced in. Jerome Powell is set to take over for Janet Yellen in February as the new Federal Reserve Chairperson. It is unlikely he will change the trajectory of increases expected in 2018.

The rate hikes have resulted in a flattening of the yield curve this year. The charts show side-by-side where the yield curve started 2017 and where it is finishing 2017. If you recall, an inversion of the yield curve, downward instead of upward sloping from left to right, or short-term rates higher than long-term rates, usually signals an oncoming recession. While we aren’t there yet, this can happen quickly, so it is something we are keeping a close eye on.

Source: http://stockcharts.com/freecharts/yieldcurve.php

Low volatility

The exciting part of 2017 was the lack of excitement. 2017 saw incredibly low average daily moves in the S&P500. You can see from the below chart that standard deviation, or the variation of price movement by percent, for the S&P 500 is well below the typical range. It is currently below 6%, which has only occurred five times since 1940. Typically, it is between 10% and 18% each year.

Source: https://www.mutualfundobserver.com/2017/09/historically-low-volatility/

During times like this, it is easy to get lulled into a false sense of security causing you to potentially reach for a little more risk to spice up your returns. But, it is important to remember that your risk tolerance isn’t nearly as stable as you think it is. Outside of our natural behavioral tendencies to want to chase great returns or hide from stocks after a sharp drawdown, our natural progression through life’s milestones can influence our tolerance for risk. Milestones like a house sale, job change, or death of a loved one can influence our desire to take on risk just like the market performance and volatility. This makes it hard to compare yourself and your portfolio’s returns to a static benchmark over the years. Before making any drastic changes to your investment strategy, it is important to discuss with your financial planner the importance of a diversified portfolio that fits with your unique long-term goals and tolerance for risk.

As we welcome the New Year, we don’t want to miss the opportunity to express our gratitude of the trust you place in us each and every day. Thank you!

On behalf of everyone here at The Center,

Angela Palacios, CFP®, AIF®

Director of Investments

Financial Advisor

Angela Palacios, CFP®, AIF® is the Director of Investments at Center for Financial Planning, Inc.® Angela specializes in Investment and Macro economic research. She is a frequent contributor The Center blog.

Check out our other Tax Reform articles:

Changes to Federal Income Tax Brackets

Changes to Standard Deduction, Personal Exemption, Misc. Deductions, and the Child Credit

Changes to State and Local Tax Deduction

Changes to Mortgage Interest Deduction (including Home Equity Loans and LOC Implications)

Changes to Estate Tax Planning in 2018 and Beyond

Changes to Charitable Giving and Deductions

Changes to Medical Deductions

Changes to Business & Corporate Tax, and Pass-Through Entities

The information contained in this commentary does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of the professionals at The Center and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. This material is being provided for information purposes only. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Please note, changes in tax laws may occur at any time and could have a substantial impact upon each person's situation. While we are familiar with the tax provisions of the issues presented herein, as Financial Advisors of RJFS, we are not qualified to render advice on tax or legal matters. You should discuss tax or legal matters with the appropriate professional. Investments mentioned may not be suitable for all investors. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. Investing involves risk and you may incur a profit or loss regardless of strategy selected. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Prior to making an investment decision, please consult with your financial advisor about your individual situation. The prominent underlying risk of using bitcoin as a medium of exchange is that it is not authorized or regulated by any central bank. Bitcoin issuers are not registered with the SEC, and the bitcoin marketplace is currently unregulated. Bitcoin and other cryptocurrencies are a very speculative investment and involves a high degree of risk. Investors must have the financial ability, sophistication/experience and willingness to bear the risks of an investment, and a potential total loss of their investment. Securities that have been classified as Bitcoin-related cannot be purchased or deposited in Raymond James client accounts.

Tax Reform Series: Changes to Standard Deduction, Personal Exemption, Misc. Deductions, and the Child Credit

Contributed by: Matt Trujillo, CFP®

The Tax Cuts and Jobs Act (TCJA) is now officially law. We at The Center have written a series of blogs addressing some of the most notable changes resulting from this new legislation. Our goal is to be a resource to help you understand these changes and interpret how they may affect your own financial and tax planning efforts.

Key Highlights:

Personal exemptions, which were previously used to reduce adjusted gross income, have been eliminated entirely

The standard deduction has been increased to $12,000 for single filers (previously $6,350) and $24,000 for joint filers (previously $12,700)

Several deductions that used to be available to tax filers that itemized their deductions have been eliminated or reduced such as:

The deduction for state and local taxes is now capped at $10,000 as opposed to the unlimited amount that was deductible under previous tax law

Lowers the threshold for mortgage interest deductibility; now only the interest on debt up to $750,000 is eligible to be deducted as opposed to $1,000,000 under previous tax law

Miscellaneous itemized deductions have been eliminated entirely as a category; these deductions included things like unreimbursed business expenses, tax preparation fees, and investment fees.

The child tax credit is expanded to $2,000 per child and is refundable meaning even if you have zero tax liability you can still get a check back from the IRS for this credit

This credit was previously $1,400 per child and would begin to phase out for joint filers at $110,000 of adjusted gross income; the credit now doesn’t begin to phase out until you reach $400,000 of adjusted gross income (for joint filers)

If you are curious to know more about how the changes may impact your specific situation please contact our office to discuss!

Matthew Trujillo, CFP®, is a Certified Financial Planner™ at Center for Financial Planning, Inc.® Matt currently assists Center planners and clients, and is a contributor to Money Centered.

Check out our other Tax Reform articles:

Changes to Federal Income Tax Brackets

Changes to Investments and the Financial Market

Changes to State and Local Tax Deduction

Changes to Mortgage Interest Deduction (including Home Equity Loans and LOC Implications)

Changes to Estate Tax Planning in 2018 and Beyond

Changes to Charitable Giving and Deductions

Changes to Medical Deductions

Changes to Business & Corporate Tax, and Pass-Through Entities

The information contained in this blog does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. This material is being provided for information purposes only. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Please note, changes in tax laws may occur at any time and could have a substantial impact upon each person's situation. While we are familiar with the tax provisions of the issues presented herein, as Financial Advisors of RJFS, we are not qualified to render advice on tax or legal matters. You should discuss tax or legal matters with the appropriate professional.

Tax Reform Series: Changes to Federal Income Tax Brackets

Contributed by: Robert Ingram

The Tax Cuts and Jobs Act (TCJA) is now officially law. We at The Center have written a series of blogs addressing some of the most notable changes resulting from this new legislation. Our goal is to be a resource to help you understand these changes and interpret how they may affect your own financial and tax planning efforts.

The TCJA brings many changes to both corporate and individual tax laws in 2018. You may be asking yourself, “what do these changes mean for me?” A good place to start may be with the new personal income tax brackets.

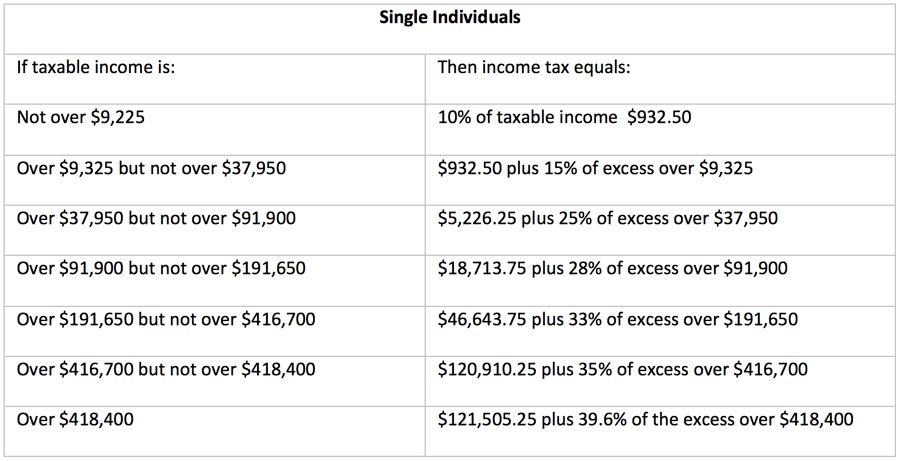

How tax brackets work

When calculating our Federal tax liability on regular income, we apply a tax rate schedule to our taxable income. The taxable income is a filer’s income after any adjustments and exclusions (adjusted gross income) and after subtracting applicable deductions and exemptions. Specific rates are then charged on different ranges of income (tax brackets) as determined by tax filing status. Currently, in 2017 there are 7 brackets where the rates are 10%, 15%, 25%, 28%, 33%, 35%, and 39.6%. The tax bracket structures and how the taxes would be assessed for two of the most common filings statuses (single and married filing joint returns) are as follows:

Current 2017 Individual & Married Tax Brackets

Under the current 2017 tax brackets, for example, a married couple filing jointly with taxable income of $150,000 would have the first portion of their income up to $18,650 taxed at 10%. The amount from $18,651 up to $75,900 would be taxed at 15% and then the remaining amount of their income from $75,901 up to the $150,000 would be taxed at 25%.

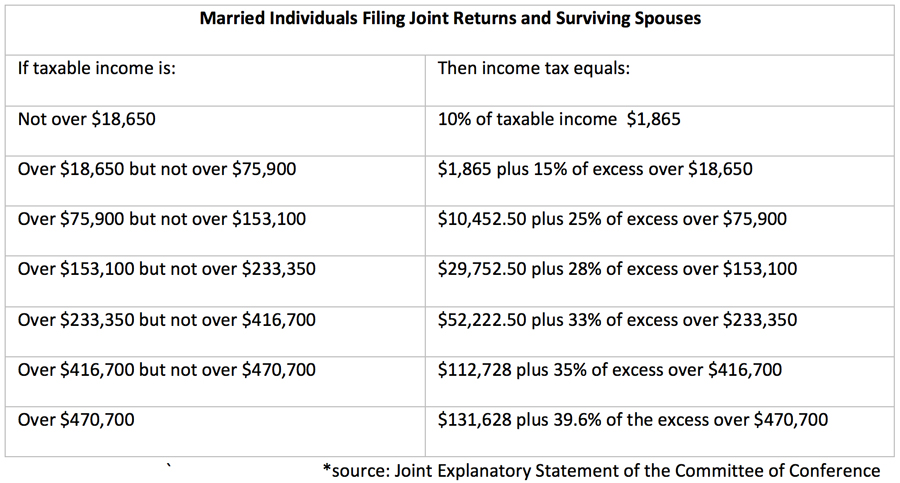

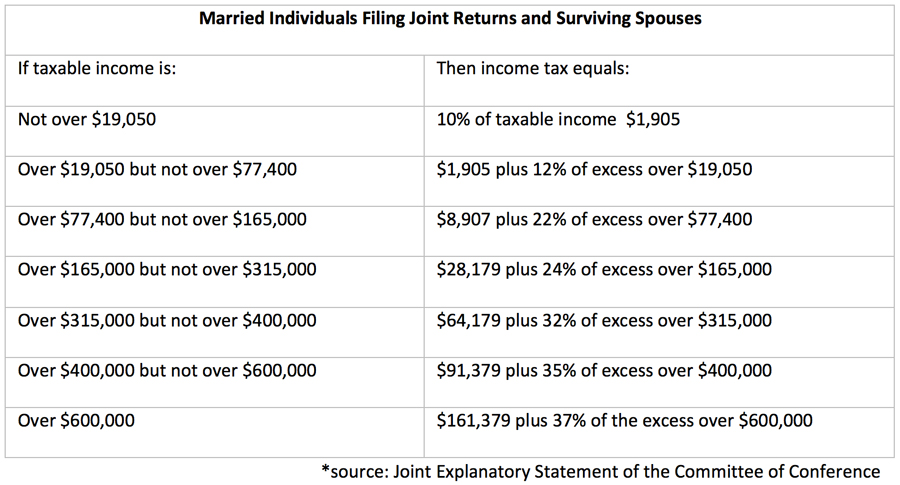

What is changing?

While the House of Representatives’ original tax reform proposal would have consolidated the 7 brackets down to 4, the final Tax Cuts and Jobs Act retains 7 brackets but reduces the tax rates on most the brackets by a couple of percentage points and adjusts the income ranges within them. The examples for those filing as single and for married couples filing jointly are below.

New 2018 Individual & Married Tax Brackets Under the TCJA

If the bracket rates are generally lower, does that mean my taxes will be lower?

Well, the good news is that the answer is…maybe.

If taxpayers apply the new tax rates in 2018 to the same level of taxable income they would have in 2017, many people would see a lower overall, effective tax rate on that taxable income. (Good news, right?) However, other changes outlined in the TCJA, such as the new standard deduction amount, the elimination of the personal exemptions, and the cap on the amount of state and local taxes that are deductible could have an impact on your taxable income amount. As a result, the actual taxes applied may or may not see as much of a reduction.

Ultimately, how your own tax situation may change in this new tax landscape will depend on a combination of factors and decisions. It is important to consult with your advisors. As always, if you have any questions surrounding these changes, please don’t hesitate to reach out to our team!

Robert Ingram is a Financial Planner at Center for Financial Planning, Inc.®

Check out our other Tax Reform articles:

Changes to Standard Deduction, Personal Exemption, Misc. Deductions, and the Child Credit

Changes to Investments and the Financial Market

Changes to State and Local Tax Deduction

Changes to Mortgage Interest Deduction (including Home Equity Loans and LOC Implications)

Changes to Estate Tax Planning in 2018 and Beyond

Changes to Charitable Giving and Deductions

Changes to Medical Deductions

Changes to Business & Corporate Tax, and Pass-Through Entities

This information and all sources have been deemed to be reliable but its accuracy and completeness cannot be guaranteed. Neither Raymond James Financial Services nor any Raymond James Financial Advisor renders advice on tax matters. Tax matters should be discussed with the appropriate professional.

Is it Time to Re-Imagine Your Retirement?

Contributed by: Sandra Adams, CFP®

You are sitting with your financial planner discussing the cash flow projections for your upcoming retirement at the beginning of 2019. You seem to have everything in place — you and your spouse are maximizing your retirement contributions at work and you are able to save additional funds into an HSA, as well as into individual IRAs and a sizable amount into your after tax investment account. You have already been trying to live on one of your salaries — simulating what you expect to spend in retirement — and things are running smoothly. Your estate planning is up-to-date and you have recently been approved for Long Term Care Insurance. All of the technical aspects of your upcoming retirement seem to be in place. There is nothing more to do except work your final year and get ready to “hang up the spurs”. Right?

It just so happens that there might be a little bit more to preparing for retirement that the “technical” side of the planning. The transition you are about to embark on is one that will take some planning from a personal standpoint. You won’t just wake up the first day of your retirement and know what to do. In fact, many clients feel somewhat lost at first.

We recommend intentionally giving some thought, or re-imagining, what you want your retirement to look like:

Give some real time and attention developing a “Bliss List,” or list of goals, dreams and desires that you would like to achieve in your retirement years will get you started. Once you have your list, you may need to build out some specifics: when, how much time, how much money, other resources and people that need to be involved.

Some of the things on your list may require you to start NOW to put in some practice, lay some groundwork, or make some connections so that you can hit the ground running when retirement day arrives. (i.e. hobbies, volunteer work, a new charitable business venture).

Coordinate your list with your spouse to make sure your list is feasible (from a time and money standpoint) and that it works for both of you. You want to make sure you have room for both your individual goals and your joint goals to make things work for your dream retirement.

The transition into retirement can be a bumpy one if you haven’t planned well both on the technical side AND on the personal side. The Center planners are trained to help you with both sides of this planning, and have the tools and resources available to assist you. If you are approaching retirement and find that you need assistance with either the technical or the personal side of retirement (or both), don’t hesitate to give us a call. We are here to help!

Sandra Adams, CFP® is a Partner and Financial Planner at Center for Financial Planning, Inc.® Sandy specializes in Elder Care Financial Planning and is a frequent speaker on related topics. In addition to her frequent contributions to Money Centered, she is regularly quoted in national media publications such as The Wall Street Journal, Research Magazine and Journal of Financial Planning.

New Team Member: Peggy Hall-Davenport, CFP®

Contributed by: Timothy Wyman, CFP®, JD

The Center is pleased and honored to announce the addition of Peggy Hall-Davenport to The Center team. After faithfully serving clients through her own practice for over 30 years, Peggy joins The Center as a Senior Financial Advisor. In this role, Peggy will continue to provide technically advanced financial planning to individuals and their families in a new team setting. “What a gift to have someone of Peggy’s integrity and experience join The Center team. Peggy, and former colleague Sandra Tutro, Registered Assistant, have taken great care of clients over the years and we look forward to supporting Peggy and clients in the future.”

In her personal time, Peggy enjoys gardening, swimming, genealogy and spending time with family. Peggy also gives back to the community through service in local Rotary and Optimist clubs.

Timothy Wyman, CFP®, JD is the Managing Partner and Financial Planner at Center for Financial Planning, Inc.® and is a contributor to national media and publications such as Forbes and The Wall Street Journal and has appeared on Good Morning America Weekend Edition and WDIV Channel 4. A leader in his profession, Tim served on the National Board of Directors for the 28,000 member Financial Planning Association™ (FPA®), mentored many CFP® practitioners and is a frequent speaker to organizations and businesses on various financial planning topics.

Branding Your New Year

Contributed by: Kimberly Wyman

*Originally posted December 30, 2015

A New Year is traditionally a time to set resolutions you hope to accomplish over the coming year. At The Center, we encourage you to Live YOUR Plan™ every day, but what a better time of the year to reinforce and embrace all that you wish to be, do and have.

Identifying the lifestyle that best suits you is similar to crafting a personal brand and crafting a personal brand can be greatly supported by setting goals a.k.a. setting New Year’s resolutions.

A personal brand is about:

Realizing you already have a personal brand – everyone does. Your existing personal brand is someone’s gut feeling about you and your existing perception of yourself. Does your brand say what you want it to say?

Acknowledging where you currently are. What is your gut feeling about yourself? What do others say?

Recognizing where you want to be. How do you want to be perceived, by yourself and by others?

Bridging the gap between the two points. This is your personal brand journey and an excellent lead-in to your desired lifestyle.

5 Ways to Brand Your New Year

What are you passionate about? Most of us know what gets us up in the morning. If you don’t, consider spending time exploring this. If you truly aren’t passionate about anything, how about if you pick something and stick with it for 3 months? By eliminating things that you’re not passionate about, it just may lead you to what you are passionate about. Knowing this passion will help you set a resolution that is sure to make you proud of yourself.

Where do your strengths lie? Sometimes we’re good at things that don’t interest us. But, understanding what we’re good at can help us leverage what we truly want by taking some of the extra legwork out of the equation.

What do you want to learn about? Are there a million things that come to mind? Just pick one to focus on. If you have nothing that comes to mind, then just pick something and stick with learning all about it for a designated period of time. Eventually, you’ll discover things you truly want to learn about via process of elimination.

Where do you want to explore? Your neighborhood? You community? Your state? Your country? The world? Pick a place. Read about it, learn about it, visit…even if only virtually. This world is pretty big and pretty small at the same time. Take time to learn about another tiny corner besides that in which you live.

Be consistent. As with any type of branding – personal or professional – branding relies on consistency. Be faithful. Be reliable. Be steadfast.

Having a clear vision of your desired lifestyle can help you make very good decisions about which paths you follow and which you choose to decline. Having a clear vision of your desired lifestyle will also make planning for your everyday and your future easier. Make life count. Live YOUR Plan™ and Happy New Year!

Any opinions are those of Kimberly Wyman and not necessarily those of Raymond James.

Top 5 Reasons You Need an Intern

Contributed by: Jaclyn Jackson

As you are wrapping up your business’ year end numbers and planning next year’s budget, consider adding “internship” as a line item. Offering an internship is a budget friendly way to lighten heavy workloads, tackle projects, and bring youthful enthusiasm to your team. Still on the fence?

These reasons may convince you to seriously consider starting an internship program.

Leverage Time – Let’s get the most obvious out of the way. An intern can make two hands four and turn twenty four hours into forty eight. Simply stated, interns can take routine or odd tasks off your plate, so you can actually get through your to-do list.

Power Through Projects – If you’re like most, there are usually one or two projects on the backburner that you don’t have the time, experience, or manpower complete. Why not hire an intern to get those projects in motion? Take advantage of the opportunity to temporarily hire someone with a specific skillset that may not be needed permanently. For example, if you are implementing a new technology, it may be more appropriate to hire an intern studying information technology than one studying a topic related to your field. Perhaps there are operational or logistical projects, marketing or media projects, etc. than an intern can develop and train you/others to maintain.

Trial Hire - Hiring an intern gives you time to discern whether someone is a good fit for your office. You can evaluate one’s ability to manage responsibilities or see how well an individual blends with your current team. Additionally, internships can help you refine a new hire role. Through the internship, you can explore the specific needs and responsibilities most helpful to taking your business to the next level as well as determine if a seasonal, part-time, or full time employee is necessary.

Save Money – If your business is small or just starting, hiring a full time employee can be quite expensive. With interns, you don’t have to worry about the overhead costs associated with a full-time employee. Furthermore, if you decided to hire an intern fulltime, you save time and money on recruiting efforts.

Move Forward – Interns can ignite forward thinking. Since most interns are college age/young adults, they are likely familiar with and comfortable using new technologies. They may assist you in identifying where you can be more productive with the use of technology. Moreover, many interns dabble in related but different fields as they endeavor to find which they’d like to pursue professionally. If you work with someone who’s had multiple internships, they can also offer insight as to how other businesses solve the problems your business is currently facing. In other words, they can provide a unique perspective that may help you maintain competitiveness with industry peers or surpass them with out of the box (outside industry) thinking.

Jaclyn Jackson is a Portfolio Administrator and Financial Associate at Center for Financial Planning, Inc.®