Contributed by: Sandra Adams, CFP®

Contributed by: Sandra Adams, CFP®

If we are being completely honest, planning and saving for retirement seems to be more and more challenging these days – for everyone. No longer are the days of guaranteed pensions, so it’s on us to save for our own retirement. Even though we try our best to save…life happens and we accumulate more expenses along the way. Our kids grow up (and maybe not out!). Our older adult parents may need our help (both time and money). Depending on our age, grandchildren might creep into the picture. Add it all up and the question is: how are we are supposed to retire? We need enough to potentially last 25 to 30 years (depending on our life expectancy). Ughhh!

While these issues certainly impact both men and women, the impact on women can be tenfold. Let’s take a look at some of the major issues women face when it comes to retirement planning.

1. Women have fewer years of earned income than men

Women tend to be the caregivers for children and other family members. This ultimately means that women have longer employment gaps as they take time off work to care for their family. The result: less earned income, retirement savings, and Social Security earnings. It can also halt career trajectory.

Action Steps

Attempt to save at a higher rate during the years you ARE working. It allows you to keep pace with your male counterparts. Take a look at the chart below for an estimated percentage of what working women should save during each period of their life.

If you are married you may want to save in a ROTH IRA or IRA (with spousal contributions) each year, even if you are not in the workforce.

If you are serving as the caregiver for a family member, consider having a Paid Caregiver Contract drawn up to receive legitimate and reportable payment for your services. This could potentially help you and help your family member work towards receiving government benefits in the future, if and when needed.

2. Women earn less than men

For every $1 a man makes, a woman in a similar position earns 82¢ according to the Bureau of Labor Statistics. As a result, women see less in retirement savings and Social Security benefits based on earning less.

Action Steps

Again, save more during the years you are working. Attempt to maximize contributions to employer plans. Also, make annual contributions to ROTH IRA/IRAs and after-tax investment accounts.

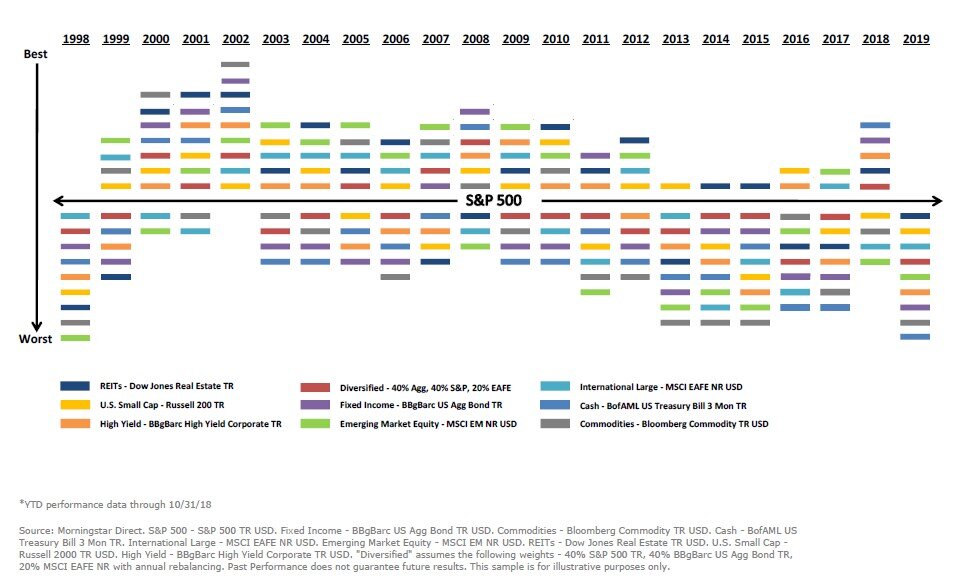

Invest in an appropriate allocation for your long term investment portfolio, keeping in mind your potential life expectancy.

Be an advocate for yourself and your women cohorts when it comes to requesting equal pay for equal work.

3. Women are less aggressive investors than men

In general, women tend to be more conservative investors than men. Analyses of 401(k) and IRA accounts of men and women of every age range show distinctly more conservative allocations for women. Especially for women, who may have longer life expectancies, it’s imperative to incorporate appropriate asset allocations with the ability for assets to outpace inflation and grow over the long term.

Action Steps

Work with an advisor to determine the most appropriate long term asset allocation for your overall portfolio, keeping in mind your potential longevity, potential retirement income needs, and risk tolerance.

Become knowledgeable and educated on investment and financial planning topics so that you can be in control of your future financial decisions, with the help of a good financial advisor.

4. Women tend to live longer than men

Women have fewer years to save and more years to save for. The average life expectancy is 81 for women and 76 for men according to the Centers for Disease Control and Prevention. Since women live longer, they must factor in the health care costs that come along with those years.

Action Steps

Plan to save as much as possible.

Invest appropriately for a long life expectancy.

Work with an advisor to make smart financial decisions related to potential income sources (coordinate spousal benefits, Social Security, pensions, etc.)

Make sure you have a strong and updated estate plan.

Take care of your health to lessen the cost of future healthcare.

Plan early for Long Term Care (look into Long Term Care insurance, if it makes sense for you and if health allows).

5. Women who are divorced often face specific challenges and are less likely to marry after “gray divorce” (divorce after 50)

From a financial perspective, divorce tends to negatively impact women far more than it does men. The average woman’s standard of living drops 27% after divorce while the man’s increases 10% according to the American Sociological Review. That’s due to various reasons such as earnings inequalities, care of children, uneven division of assets, etc.

The rate of divorce for the 50+ population has nearly doubled since the 1990s according to the Pew Research Center. The study also indicates that a large percentage of women who experienced a gray divorce do not remarry; these women remain in a lower income lifestyle and less likely to have support from a partner as they age.

Action Steps

Work with a sound advisor during the divorce process, one who specializes in the financial side of divorce such as a Certified Divorce Financial Analyst (CDFA) (Note: attorneys often do not understand the financial implications of the divorce settlement).

6. Women are more likely to be subject to elder abuse

Women live longer and are often unmarried or alone. They may not be as sophisticated with financial issues. They may be lonely and vulnerable.

Action Items

If you are an older adult, put safeguards in place to protect yourself from Financial Fraud and abuse. For example: check your credit report annually and utilize credit monitoring services like EverSafe.

Have your estate planning documents updated, particularly your Durable Powers of Attorney documents, so that those that you trust are in charge of your affairs if you become unable to handle them yourself.

If you are in a position of assisting an older adult friend or relative, check in on them often. Watch for changes in their situations or behavior and do background checks on anyone providing services.

While it is unlikely that the retirement challenges facing women will disappear anytime soon, taking action can certainly help to minimize the impact they can have on women’s overall retirement planning goals. I have no doubt that with a little extra planning, and a little help from a quality financial advisor/professional partner, women will be able to successfully meet their retirement goals.

If you or someone you know are in need of professional guidance, please give us a call. We are always happy to help.

Sandra Adams, CFP®, is a Partner and CERTIFIED FINANCIAL PLANNER™ professional at Center for Financial Planning, Inc.® and holds a CeFT™ designation. She specializes in Elder Care Financial Planning and serves as a trusted source for national publications, including The Wall Street Journal, Research Magazine, and Journal of Financial Planning.

Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Raymond James is not affiliated with EverSafe.

The cost and availability of Long Term Care insurance depend on factors such as age, health, and the type and amount of insurance purchased. These policies have exclusions and/or limitations. As with most financial decisions, there are expenses associated with the purchase of Long Term Care insurance. Guarantees are based on the claims paying ability of the insurance company.