Contributed by: Nick Defenthaler, CFP®, RICP®

Contributed by: Nick Defenthaler, CFP®, RICP®

2022 has been like a Michigan highway this year for financial markets – lots of potholes and certainly not a smooth ride to your destination. What makes this year's market volatility so frustrating is that we have seen the bond market struggle alongside equity markets. In most market corrections, bonds have a negative correlation with stocks, which is just a fancy way of saying stocks Zig when bonds Zag – they move in different directions when things get ugly. While this is a general rule of thumb, as we have seen this year, there are periods where stocks and bonds can be down at the same time (click here to learn more and read our latest quarterly Investment Commentary).

A reasonable question that many of our clients have either asked us directly or are likely thinking to themselves is, "what moves should we be making given the current state of the economy and market?". Our firm does not believe in market timing or abandoning an evidence-based investment strategy because of market volatility that we believe comes with being a long-term investor. However, this certainly does not mean that we sit around doing nothing! In addition to making strategic adjustments within your portfolio that align with our current view and outlook for fixed income and equity markets, there are several financial planning concepts we review and consider that have been proven to add value to a client's financial plan over time. Let's dig into what some of those strategies are:

Tax Loss Harvesting

Intentionally selling positions at a loss within an after-tax investment account (trust account, joint, individual account, etc.) to help offset capital gains generated in the future, or even a portion of your ordinary income, is something we act on frequently for clients during times of market volatility. When loss harvesting is completed, we invest the sale proceeds in a similar fund for 31 days, so you are not "out of the market" and, in many cases, re-purchase the exact positions we sold one month prior. Click here to learn more about this strategy and why it can help improve the most important return for any investor – your AFTER-TAX rate of return!

Roth IRA Conversions

Given our historically low tax environment and a strong likelihood that these low rates expire at the end of 2025 (2017 Tax Cuts & Jobs Act), moving funds from Traditional IRAs to Roth IRAs through income acceleration has been a popular strategy over the past five years. Roth IRA conversions become an even more compelling strategy during times of market volatility because you can convert more shares of an investment at the same target dollar amount for the conversion.

For example, if Joe Client (age 62) plans to convert $30,000 to his Roth IRA in 2022 to maximize the 12% marginal tax bracket, we might consider converting funds of his ABC stock mutual fund. With being currently valued at $10/share, we would be converting 3,000 shares. However, because of recent market volatility, ABC mutual fund's share price has dropped to $8.50/share – down 15%. This means we can still target the same $30,000 conversion to maximize the appropriate tax bracket; however, we can now convert nearly 3,530 shares – 530 more than before the decline in share price. When the market recovers, the "snap back growth" with additional shares will occur completely tax-free within the Roth IRA!

Portfolio Rebalancing

Buying low and selling high – the cornerstone of almost every investment strategy! At its core, that is really what portfolio rebalancing is all about. When we proactively manage your investments and allocation, your planner and our dedicated in-house investment department are working in tandem, reviewing your plan to ensure your target allocation is always in balance. Thinking back to late March 2020 in the depths of the COVID bear market, a client who had a target portfolio mix of 60% stock, 40% bond was now sitting at roughly 54% stock, 46% bonds because equity markets were down 30+% and many bond funds were up 3-5% for the year. When we hit certain thresholds that made sense for each client's customized financial plan, we sold bonds in positive territory and bought stocks funds that were trading at a deep discount to get the client back to their target allocation of 60% stock, 40% bond. Let's be honest – rebalancing when markets are up where we are trimming profits (which we did a lot of last year, especially in Q4 2021) is a lot easier than selling our safe, more conservative bonds and buying stock when there is fear and uncertainty in markets. That said, in our opinion, a disciplined and intentional rebalancing strategy under EVERY market condition is key to helping you achieve the rate of return necessary to attain your short and long-term financial goals.

Cash Reserves

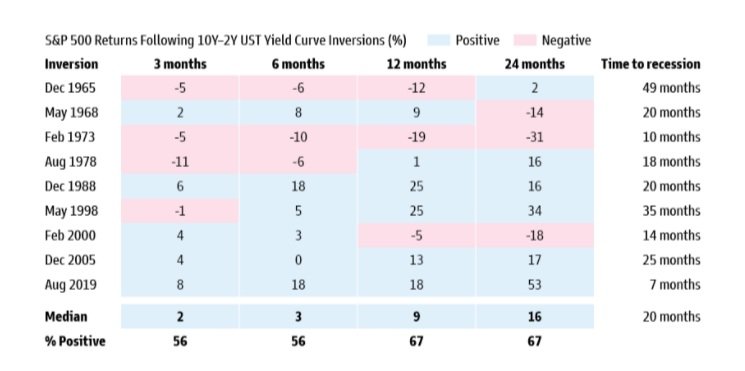

While working, especially in our younger years, it is always a great idea to have at least three months of living expenses set aside as an emergency fund. Having even more in cash (6-24 months) might be advisable, depending on one's career. However, as you enter the wonderful world of retirement, you no longer have to protect against a sudden loss of employment income. If that was a concern, chances are you would not be in a position to retire in the first place! Having adequate cash reserves when you are in "distribution mode" is key. In most years, the S&P 500 will fall 5% or more on three to four separate occasions, and on average, it is common to see a pullback of 14% or more at least once a year. Check out the chart below that JP Morgan updates annually – it is a favorite of mine for a self-proclaimed "financial planning nerd." However, despite those intra-year disruptions, markets typically end the year in positive territory about 75% of the time.

Think of having adequate cash in your investment accounts to support your monthly or periodic portfolio distributions as your umbrella to keep you dry during a brief rain shower. So how do we do this? What's the strategy? Concepts that we have seen work well for the hundreds of retired clients we have the pleasure of serving are simple yet incredibly effective:

Having dividends, interest, and capital gain distributions pay to cash instead of being re-invested – we consider this our "dry powder."

Portfolio rebalancing – as noted above, trimming profits or areas of your investments that have become overweight are naturally good ways to rebuild your cash bucket to help support your retirement income needs.

Helping to construct and navigate your financial plan is truly our passion. Thank you for your continued trust and confidence in our team. We are grateful to be part of your financial team!

Nick Defenthaler, CFP®, RICP®, is a Partner and CERTIFIED FINANCIAL PLANNER™ professional at Center for Financial Planning, Inc.® Nick specializes in tax-efficient retirement income and distribution planning for clients and serves as a trusted source for local and national media publications, including WXYZ, PBS, CNBC, MSN Money, Financial Planning Magazine and OnWallStreet.com.

This material is being provided for information purposes only and is not a complete description, nor is it a recommendation. Any opinions are those of the author and not necessarily those of Raymond James. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Rebalancing a non-retirement account could be a taxable event that may increase your tax liability. Conversions from IRA to Roth may be subject to its own five-year holding period. Unless certain criteria are met, Roth IRA owners must be 59½ or older and have held the IRA for five years before tax-free withdrawals of contributions along with any earnings are permitted. Converting a traditional IRA into a Roth IRA has tax implications. Investors should consult a tax advisor before deciding to do a conversion. Matching contributions from your employer may be subject to a vesting schedule. Please consult with your financial advisor for more information. Rebalancing a non-retirement account could be a taxable event that may increase your tax liability.